does kansas have an estate or inheritance tax

Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. Prior to 2018 the Federal Estate Tax Exemption was 549 million for individuals and 1098 million for married couples.

States You Shouldn T Be Caught Dead In Wsj

No estate tax or inheritance tax.

. No estate tax or inheritance tax. Maryland and New Jersey have both. Many states repealed their estate taxes as a result.

In 2018 the Federal Estate Tax Exemption was increased under the Tax Cut and Jobs Act. No estate tax or inheritance tax. Property Taxes and Property Tax Rates Property Tax Rates In Kansas property taxes are set at the local level.

Kansas Inheritance and Gift Tax. The state sales tax rate is 65. Hi Does Kansas have an inheritance taxwould it apply to someone living in Arizona.

The top inheritance tax rate is18 percent exemption threshold. Would the inheritance tax be imposed on all other income not matter where it came from when inherited because of the location of the tax prep. The estate tax is paid by the estate whereas the inheritance tax is levied on and paid by the beneficiary who receives a specific bequest.

If person living in Arizona had taxes prepared in Kansas because of income received from Kansas. We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

Some states have inheritance tax some have estate tax some have both some have none at all. The inheritance tax is a tax on a beneficiarys right to receive property from a deceased person. Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9.

The amount of the inheritance tax depends on the relationship of the beneficiary to the deceased person and the value of the property. State inheritance tax rates range from 1 up to 16. No estate tax or inheritance tax.

Surviving spouses are always exempt. The state with the highest maximum estate tax rate is Washington 20 percent followed by ten states and the District of Columbia with a top rate of 16 percent. A 1 million estate in a state with a 500000 exemption would be taxed on 500000.

The top estate tax rate is 16 percent exemption threshold. But that changed in 2001 when federal tax law amendments eliminated the credit. This increases to 3 million in 2020 Mississippi.

Generally the closer the relationship the greater the exemption and the smaller the tax rate. This means that any portion of an estate that was over the exemption rate was taxed at 40. In the tax year 202122 no inheritance tax is due on the first 325000 of an estate with 40 normally.

The federal estate tax return offered a credit toward state-level estate taxes and states based their own tax rates on this federal credit. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. What Is The Federal Estate Tax Rate.

In addition to the. The top inheritance tax rate is18 percent exemption threshold. How an Estate Tax Works.

The sales tax rate in Kansas is 65. In 2022 Connecticut estate taxes will range from 116 to 12 with a. Its based on the value of.

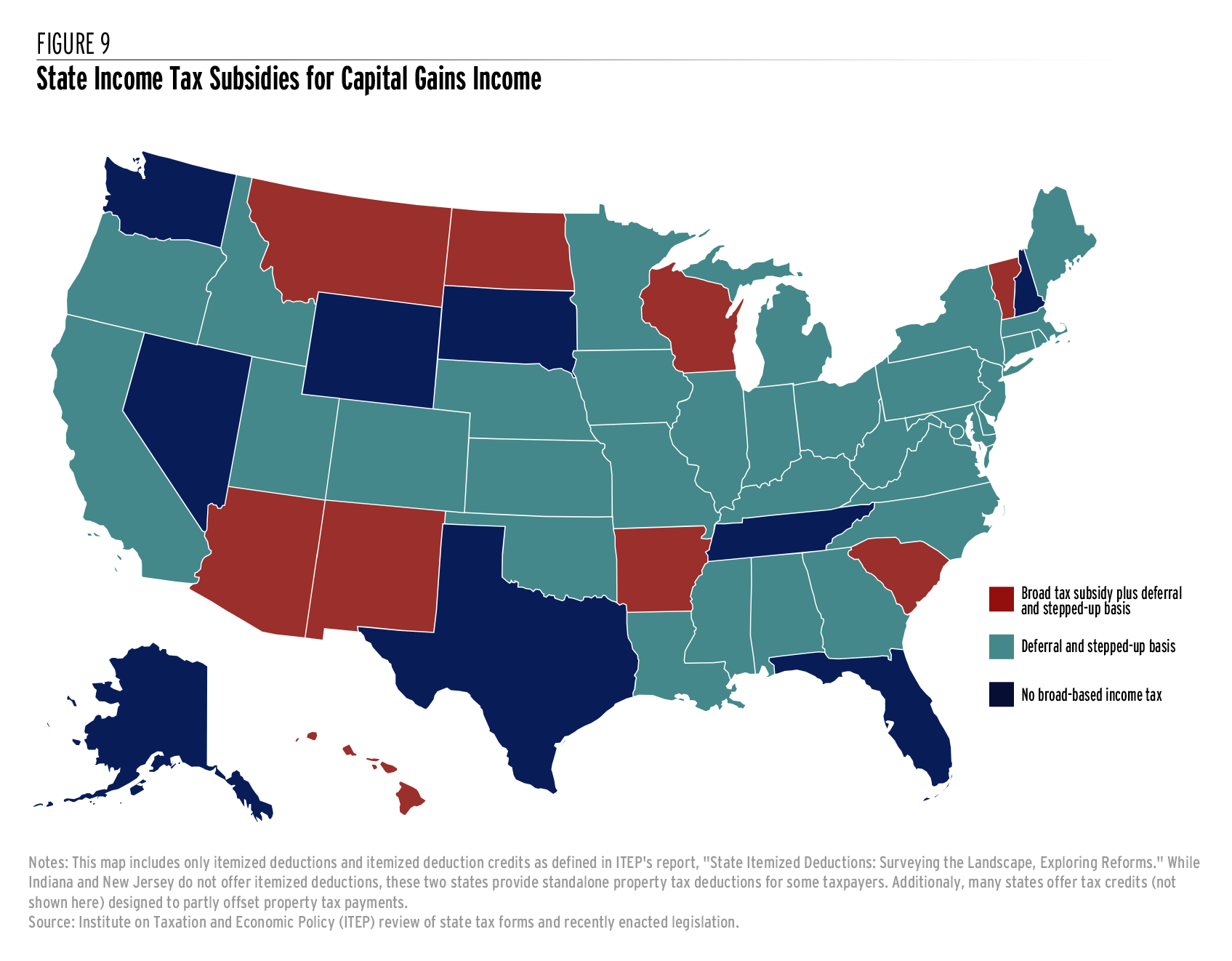

Capital Gains Taxes Capital gains are taxed as. Like most states Kansas has a progressive income tax with tax rates ranging from 310 to 570. Currently fourteen states and the District of Columbia impose an estate tax while six states have an inheritance tax.

At one point all states had an estate tax. Is there an amount you can receive before the.

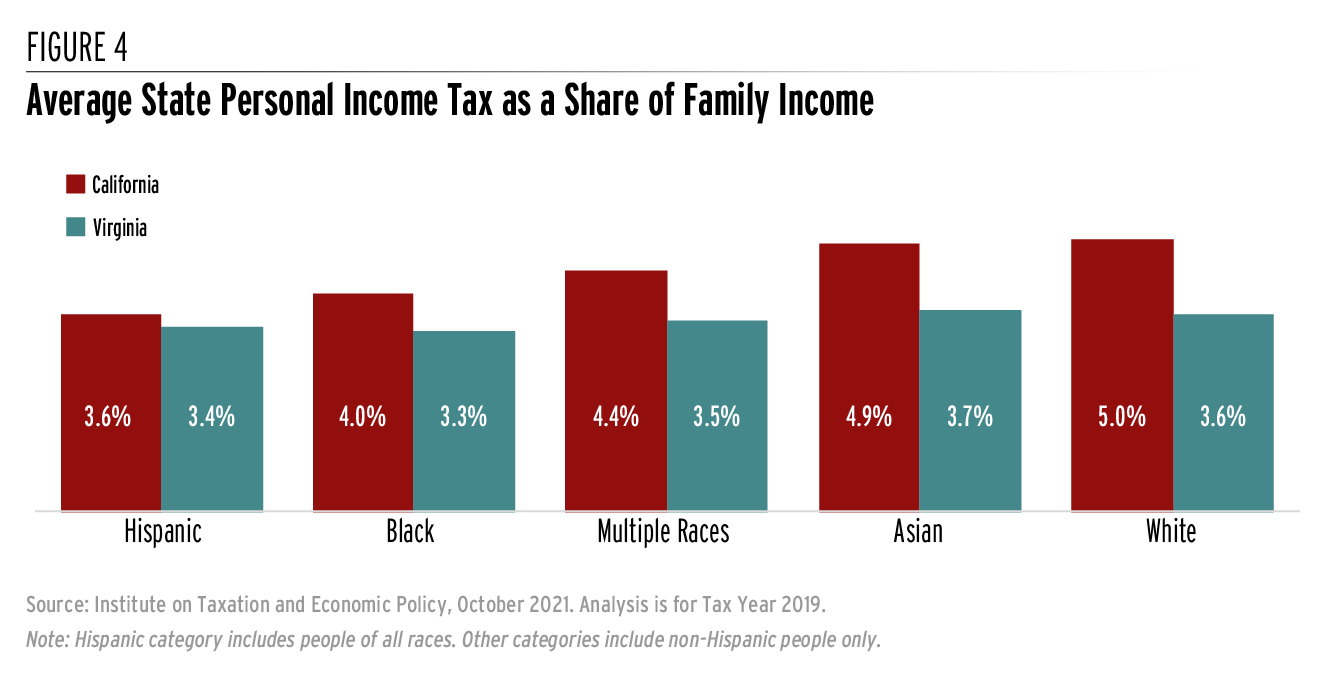

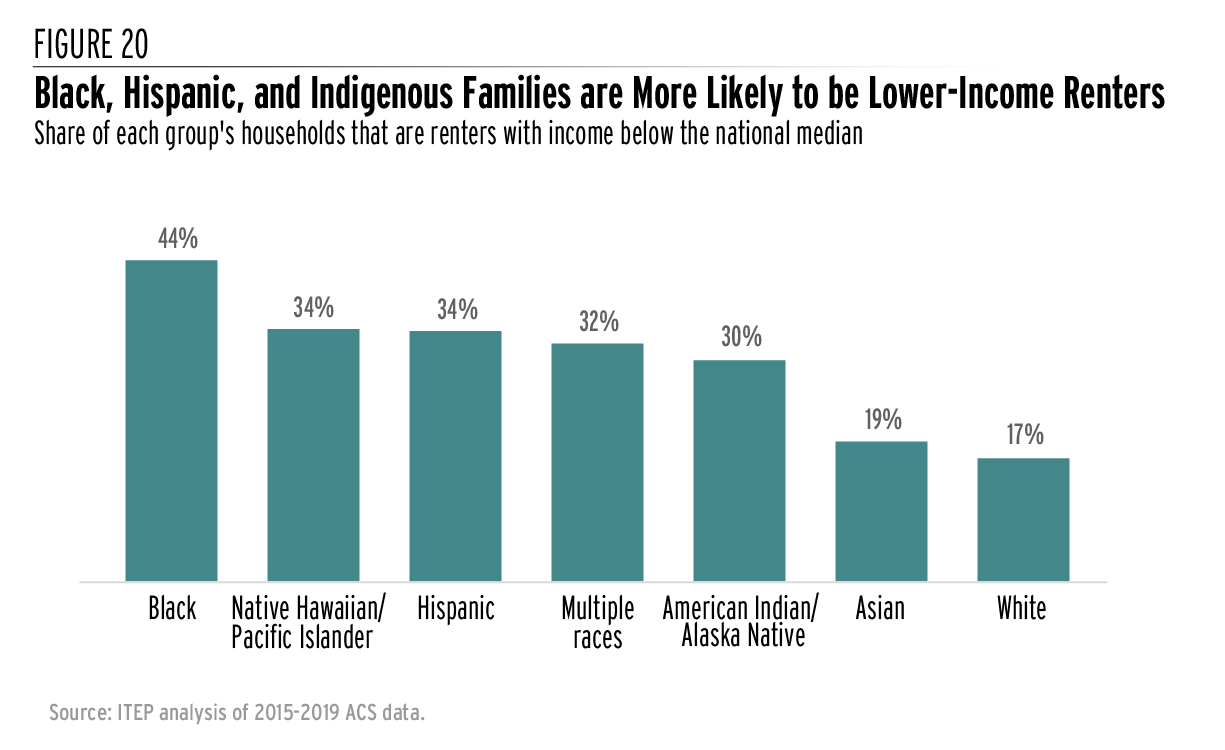

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Taxes Archives Skloff Financial Group

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

How Is Tax Liability Calculated Common Tax Questions Answered

States You Shouldn T Be Caught Dead In Wsj

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

Maryland To Cut Estate Tax As Blue States Fall In Line

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

States You Shouldn T Be Caught Dead In Wsj

How Is Tax Liability Calculated Common Tax Questions Answered