nevada estate tax rate 2021

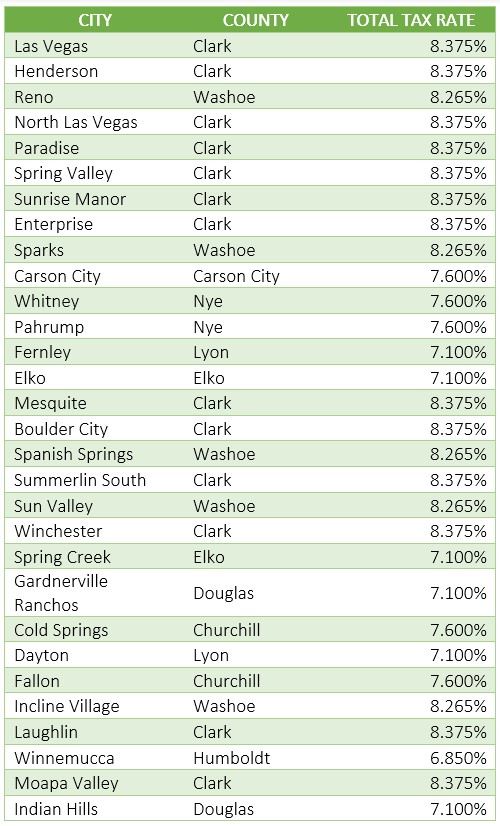

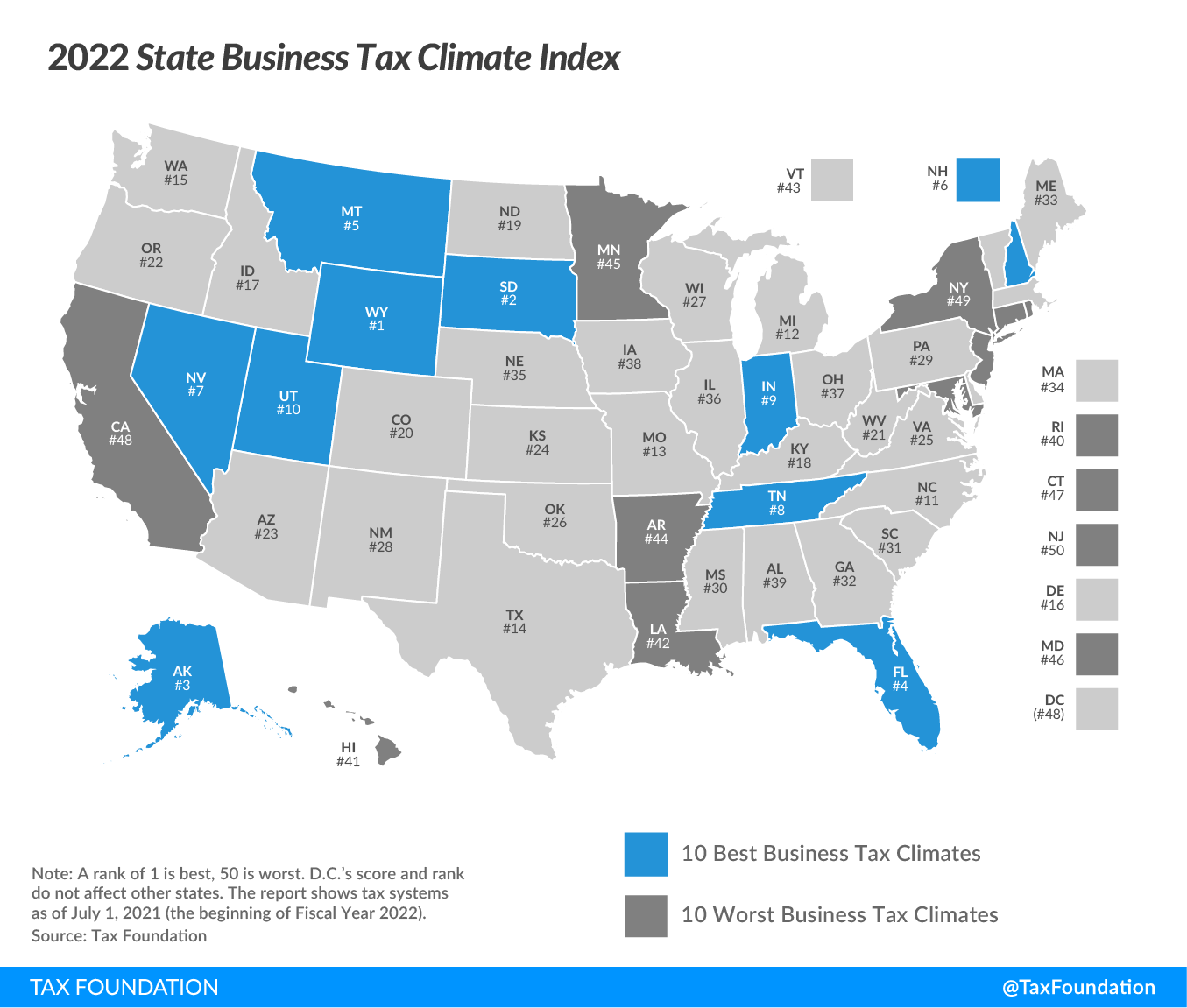

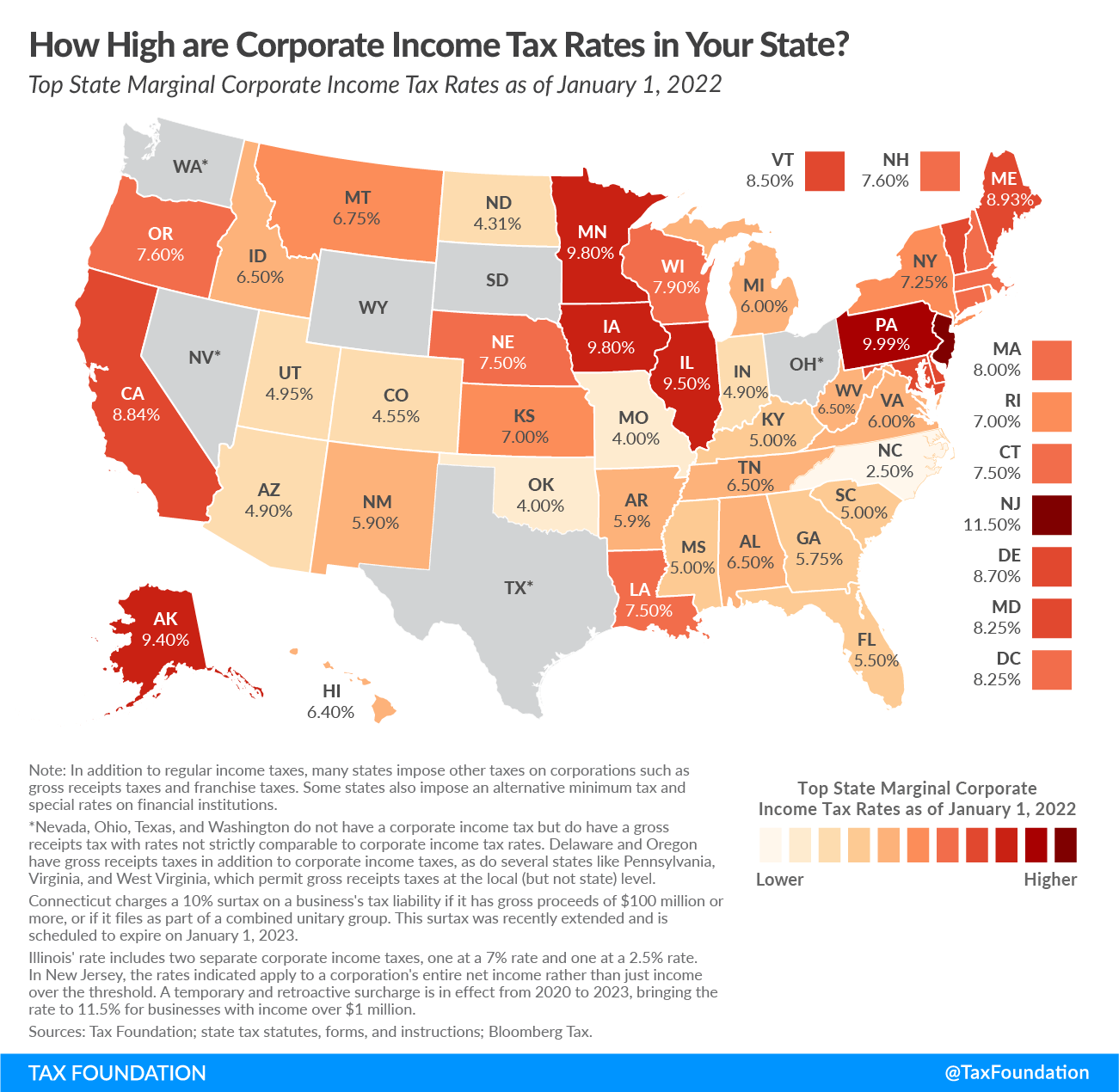

Nevada does not have a corporate income tax but does levy a gross receipts tax. Nevada has a 685 percent state sales tax rate a max local.

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

. Counties in Nevada collect an average of 084 of a propertys assesed fair. 2020 - 2021 TAX RATE FISCAL YEAR 2021 - 2022 TAX RATE FISCAL YEAR 2022 -. Property Tax Rates Linda Jacobs Washoe County Treasurer.

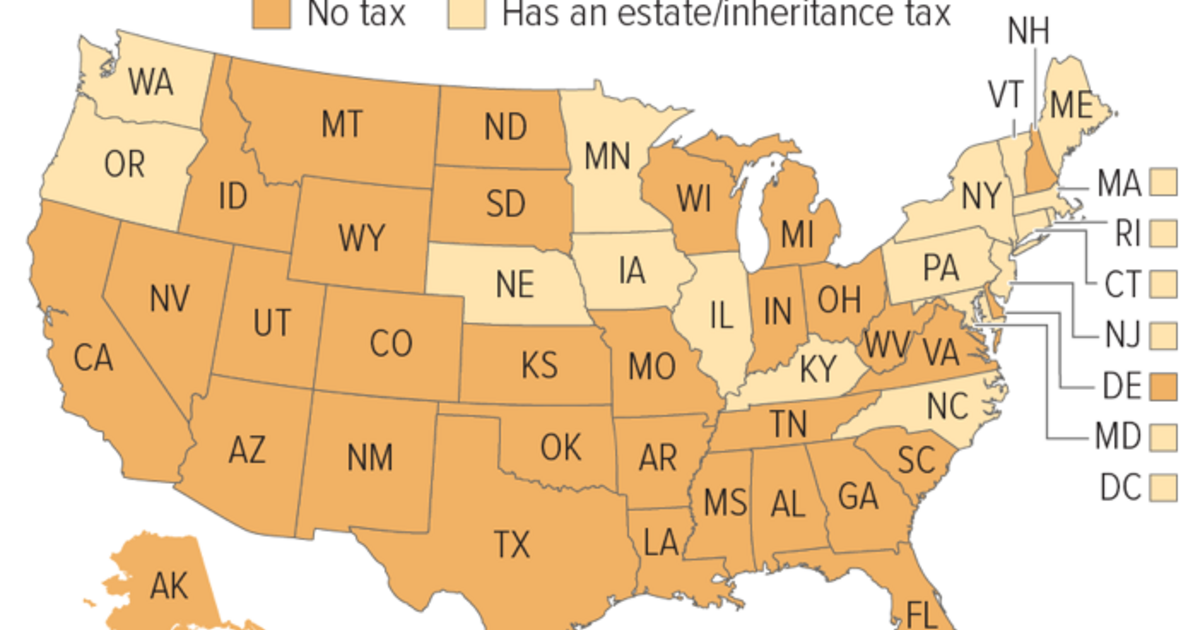

Under Nevada law there are no inheritance or estate taxes. Thus if your County Assessor determines your homes taxable value is 100000 your assessed value will be 35000. Determine the assessed value by multiplying the taxable value by the assessment ratio.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. So even though Nevada does not have. The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000.

Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues. Nevada does not collect an estate. 31 rows The latest sales tax rates for cities in Nevada NV state.

Nevada does not have an individual income tax. Tax District 200 Tax Rate 32782 per hundred dollars. It is one of the 38 states that does not apply an estate tax.

The property may be redeemed by payment of taxes and accruing taxes penalties and cost together with interest on the taxes at the rate of 10 percent per annum from the original date. CLARK COUNTY TAX RATES A tax district is an area defined within a county for taxing purposes. Tax rates apply to.

STATE OF NEVADA. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The Leading Online Publisher of National and State-specific Probate Legal Documents.

Clark County collects on average 072 of a propertys assessed fair. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Assessed value is equal to 35 of that taxable value.

Rates include state county and city taxes. Shooting Death of Reno Man in December 2021 Results in Conviction Call 311 to find resources ask questions and utilize. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

But Nevada does have a relatively high sales tax a state rate is around 7 but goes to approximately 8 when you consider local tax rates. Nevada estate tax rate 2021 Sunday June 12 2022 The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. 2020 rates included for use while preparing your income tax.

If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax. CLARK COUNTY PROPERTY TAX RATES Fiscal Year 2020-2021. Nevada repealed its estate tax also called a pick-up.

The median property tax in Clark County Nevada is 1841 per year for a home worth the median value of 257300. 200000 taxable value x 35. District 902 - MESQUITE CITY REDEVELOPMENT.

Taxes In Nevada U S Legal It Group

Nevada Tax Rates Rankings Nevada State Taxes Tax Foundation

Nevada Sales Tax Guide For Businesses

City Of Reno Property Tax City Of Reno

Nevada Tax Rates And Benefits Living In Nevada Saves Money

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Nevada Vs California Taxes Explained Retirebetternow Com

Taxes In Nevada U S Legal It Group

Nevada Tax Rates Rankings Nevada State Taxes Tax Foundation

Nevada Budget Overview 2019 2021 Guinn Center For Policy Priorities

Taxes In Nevada U S Legal It Group

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Nevada Tax Advantages Luxury Real Estate Advisors Las Vegas Real Estate

How High Are Cell Phone Taxes In Your State Tax Foundation

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty