alabama delinquent property tax laws

When purchasers buy tax lien. The State of Alabama owns tens of thousands of tax-delinquent properties and that number is increasing at an alarming rateAccording to a recent Cumberland Law Review.

2021 Jefferson County List Of Delinquent Residential Business Property Taxes Al Com

The interest is equivalent to 1 of the tax per month plus a delinquency fee of 500 per parcel.

. Beginning on January 1st interest and fees accrue on delinquent property taxes. The 2022 Alabama Tax Auction Season completed on June 3 2022. Good news - You dont have to wait for the annual tax.

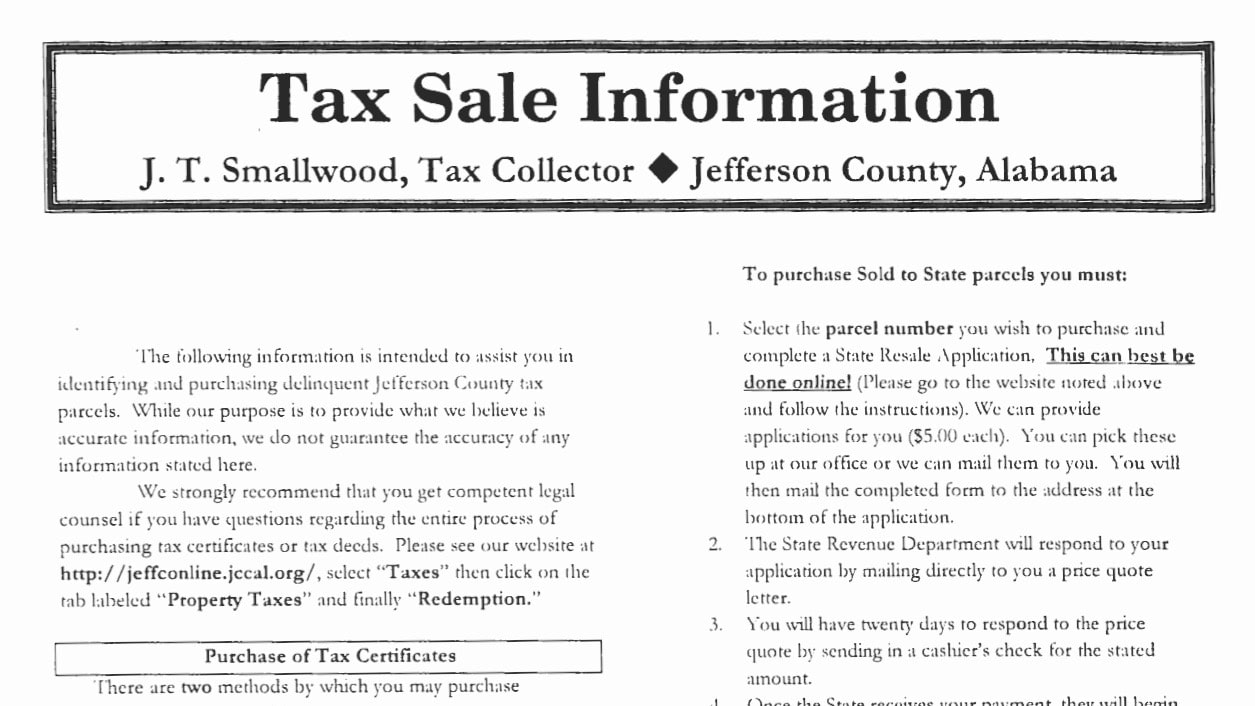

The Marshall County Revenue Commissioner hereby declares hereafter the remedy for collecting delinquent property taxes by the sale of a tax lien. Interested in buying tax properties in Alabama now. Step 1 Find out how tax sales are conducted in your area.

The Revenue Commissioner is authorized to secure payment of delinquent taxes through a tax lien auction in which the perpetual first priority lien provided by Alabama Code. Call your county tax collection office better yet visit in. Section 24-9-6Acquisition of tax delinquent properties.

You may search for transcripts of properties currently available by County CS Number Parcel Number or by the persons name in which the property was assessed when it sold to the State. The steps to buying a property for delinquent taxes. So if you dont pay the real property.

Tax Sales of Real Property in Alabama. CODE 40-10-180 THROUGH 40-10-200The second mechanism for Alabama counties to collect delinquent taxes was more firmly established by the Alabama legislatures. Each taxpayer is required by Alabama Law.

If another party buys the lien you may. A Alabama tax lien certificate transfers all the rights that come with being the owner of the real estate tax lien from Jefferson County Alabama to the investor. Up to 25 cash back All states have laws that allow the local government to sell a home through a tax sale process to collect delinquent taxes.

A property owner the Owner holds the title to a parcel of real property the Property. Up to 25 cash back In Alabama if the state buys the tax lien the property may be redeemed at any time before the title passes out of the state. Every year ad valorem taxes.

A In the event that the local governing body city or county elects to participate in the program under this chapter by entering into an.

Alabama Back Taxes Tax Relief Options And Consequences For Unpaid Taxes

2018 Lee County Delinquent Tax List 1st Run By Opelikaobserver Issuu

Jefferson County Personal Property Tax Audits

Quiet Title Program Birmingham Land Bank Authority

Al Adv Ld 2 2011 2022 Fill Out Tax Template Online

Can I Appeal My Property Tax Bill In Alabama Davis Bingham Hudson Buckner P C

![]()

National Property Tax Updates Property Tax Resources

Tax Lien Sale Tuscaloosa County Alabama

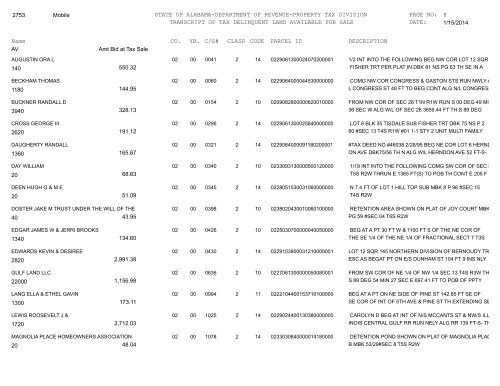

02state Of Alabama Department Of Revenue Property Tax Division

Abandoned Properties Locked In Limbo As The Tax Bill Grows Wbhm 90 3

Alabama Legislator Seeks To Reform Alabama Property Tax Law Al Com

Late Paying Your Property Tax Investors See An Opportunity Wbhm 90 3

Is Alabama A Tax Lien Or Tax Deed State

Alabama Property Tax H R Block

Investing In Tax Liens Is It A Good Idea Alabama Real Estate Lawyers